Questions for the Authorities

We are putting together questions for the RAM Investors Group (RAMIG) to ask the authorities. Last updated 22/4/14

Our members should feel free to contribute any additional questions via this email

The liquidation of RAM is seemingly being carried out under a veil of strict secrecy. After well over a year there are still far more questions than answers, as the reader will see from the long list of questions below. There is no explanation for the suffocating secrecy; it is not the practice in overseas jurisdictions we have been able to observe.

Who are the ‘authorities’ we expect answers from? The ‘authorities’ include the Financial Markets Authority (FMA) ,the Serious Fraud Office (SF0), PwC the liquidator (who is an officer appointed by the High Court), the courts themselves, and of course the responsible politicians including the Minister of Commerce.

Previous attempts to secure information from the authorities have been frustrated by ongoing court proceedings against David Ross. Investors have been waiting over a year for more complete information.

Ross pleaded guilty to all charges and, in so doing, accepted the facts as alleged by the SFO and the FMA, and their evidence against him. Ross’s ongoing appeal (against his sentence, not his conviction) is only concerned with the penalty that should be imposed on him for his offending; it does not challenge the facts or evidence. Accordingly, supplying information to investors could not possibly compromise Ross’s appeal rights, or his rights to a fair hearing. Further, it would be unkind and unfair to leave hundreds of investors, who have lost their life savings, waiting in a state of hopelessness. RAMIG submits, under the circumstances, the appeal by Ross (and possible subsequent appeal) should not be allowed to stand in the way of a constructive and comprehensive supply of information by the authorities to the investors.

RAMIG further submits a full information transfer would be consistent with the principles of the Victims’ Rights Act, which requires victims to be treated with courtesy and compassion, and respect to their dignity and privacy, and for information to be automatically released to victims.

Our initial list of questions includes:

*1 The process of forensic accounting to determine if hidden caches of investor funds exist. The recent finding (or perhaps highlighting) of an unknown Ross family trust containing significant share investments (approximately NZ$250,000) casts grave doubt on the level of forensic accounting performed so far, or the level of diligence in perusing such caches.

*2 What potential actions the authorities can take or are taking to recover investments stolen by David Ross, directly or through his companies.

*3 What work the authorities have done to reconcile all the records David Ross or his companies kept, all associated bank accounts, broker accounts etc to identify all cash flows and any sinks where money could have been made to disappear. Has a full and comprehensive forensic analysis been performed of all transactions?

*4 What the authorities are doing to identify the trends that strongly indicate significant investor knowledge that RAM was a Ponzi/fraudulent in at least the last 3 years (increased cash outflow, decreased cash inflow, warnings to the authorities (which were ignored)), and apparent delaying tactics by certain investors who stood to gain by delaying intervention of the authorities. What have the authorities done to identify complicit parties?

*5 An indication of why so few charges were laid against David Ross considering the gross scale of his fraud and how sentences in future may be targeted to a level that provides a realistic disincentive to those who seek to cause such large scale fraud?

*6 What the authorities have identified about the level of Ponzi versus share trading carried out by Ross?

*7 What involved parties are now subject to confidentiality agreements and why (eg the RAM office staff)?

*8 What agreements were made with David Ross as part of his plea bargaining, if any?

*9 What action is to be taken against RAM’s bankers for failure to act according to the Anti Money Laundering and Countering Financing of Terrorism Act 2009?

*10 Will the actions (or failure) of IRD to detect money laundering/fraud by Ross be investigated?

*11 Do the authorities take any pro-active measures to investigate financial organisations who are consistently producing or promising returns that are not consistent with the current industry norm?

*12 Have the authorities examined the involvement of other financial companies who worked closely with RAM (eg those that recommended or used the services of RAM, or provided services to RAM)?

*13 How were key items of information (such as the fact that $115 m was stolen) been derived? Can the full calculations and assumptions be provided?

*14 What are the authorities doing to ensure specific legislation is quickly put in place to overcome the obvious shortcomings of the current recovery legislation such as:

**provide a clear and quick and full recovery path in situations like RAM,

**to protect the property rights of investors

**to reduce the recovery (claw back) costs to investors

**to ensure the financial industry participates in recovery costs through a fidelity fund,

**to ensure recovery does not depend on dollar by dollar tracking of money transfers but can deal coherently with overall macro trends of the fraud.

The following questions have been received from RAMIG members (all names and details removed of course). They are presented here with only slight editing in some cases. Sometimes the same questions are repeated by different members, or in a limited number of cases we may already have answers or partial answers already, but we publish everything anyway.

*15 A Ross family trust was recently discovered, which had several hundred thousand dollars of shares in it. How was it the SFO did not know of the existence of this trust when it is assumed one of the first questions it would have asked Ross and his family would have been “in which trusts is Ross either a beneficiary, trustee, appointor or settlor?”

*16 As a result of the discovery of this trust, has the SFO gone back to the Ross family to confirm if Ross has any interest (e.g. trustee, beneficiary, director, shareholder) in any other entity (e.g. trust, company)?

*17 Given Ross appeared to be a very successful financial adviser, does the SFO know why the Ross family appears to have had such little money invested with him? Is this suspicious or unusual? [RAMIG comment. We don’t know if the Ross family were significant investors in RAM, this is one of the first questions that needs to be answered]

*18 The SFO could have charged Ross each year, for 12 years, for fraudulent use of a document, namely, the quarterly reports he produced. Because each offence is separate, but on-going, the SFO could have argued these offences be treated cumulatively. But it didn’t. Why not?

*19 Given all the missing information, why should RAM victims be confident the SFO has thoroughly investigated the full extent of Ross’s fraud?

*20 Please add a question about ‘knowledge other people had (perhaps investors) who didn’t say anything so as to get their money out of RAM’ e.g. what about the Accountant who worked for David Ross – how is it that he didn’t notice anything was up?

*21 Please ask why David Ross has not been made bankrupt? Surely that cannot be part of his plea bargain?

*22 Have all parties who withdrew money in the last 2 years been required to provide all records (phone, email, bank account information etc) of their business transactions with RAM? [RAMIG comment. We need to ask for the last 6 years at least, not just 2 years.]

*23 Why have the RAM office staff not been required to provide evidence, they must have seen it all, especially in the last few months?

*24 It looks fairly comprehensive but would it be appropriate to add a question about ‘knowledge other people had’ (perhaps investors) who didn’t say anything so as to get their money out of RAM’ e.g. what about the Accountant who worked for David Ross – how is it that he didn’t notice anything was up?

*25 Pls ask why David Ross has not been made bankrupt? Surely that cannot be part of his plea bargain?

*26 If the FMA was the authority to license brokers/financial advisers, what extent of liability should they take for licensing David Ross, particularly in view of the high returns he was purported to have made for his clients, and the knowledge that the previous Securities Commission had been provided with regarding his asset management company.

What has happened to his assistants, who were also licensed brokers (particularly the person who was herself a licensed broker and approved by the FMA). Did his company have professional liability insurance?

What about those who put substantial cash advances in in years 3-4 and 5 going back?

*27 Is anyone taking a personal action against David Ross the thief?? This is not an FMA one I realise but more directed at the liquidator.

*28 I had heard, through the grape-vine, that at least one of the banks, when prospective borrowers listed their assets, would not allow any investment with Ross Asset Management to be included! This was well before the red flag went up! I wonder how long, within the financial sector, the suspicions about RAM were suppressed?

*29 I had a discussion with a Lower Hutt real estate agent who stated the house that david bought has had hundreds of thousands of $ spent on it. If this money was the proceeds of crime some of the sale funds should come back.

*30 Could we potentially use the Proceeds of Crime Act against David Ross?

*31 I invested several hundred thousand dollars less than 6 months prior to the Ross shut down , I firmly believe that his two employees must have been receiving calls from distressed clients well before that point and must have known things were not right at the very least ,yet they receipted my funds for Ross , have these two been investigated they at least must have a duty of care if they knew he was insolvent wasn’t one of them an accountant ? I do not believe they had no idea what was going on.

I suspect he passed my funds straight on to associates and friends that knew he was running a Ponzi

Ross is a Mastermind he has planned for his downfall , he has it all worked out

*31 Have the total amount of funds in David Ross’s offshore account in Mauritius (or where ever) been discovered? If so, how much is there? If not. Why not?

*32 Does the person or persons who supported and signed the application of David Ross to be accredited by the FMA have any legal responsibility?

*33 Why has the FMA not been held accountable, especially after their in-action on allegations about David Ross some 2-3 years earlier?

Why were the charges against David Ross so weak?

In the recent ruling where his wife got 50% of the proceeds of sale of house/assets and separately the children got 50% of another Trust – why is this so? How can we be certain the money invested in the Trust and the house, etc wasn’t through ill-gotten gains?

It is my understanding that David Ross got a reduction in sentence for his remorse? He is a master liar. How could the judge truly believe his remorse? It’s a farce.

Where was the so-called protection for investors? FMA? Securities Commission prior to that? NZICA?, etc. Why are they all not being held accountable? They failed the very people they’re mandated to protect!

Our investments were part of a massive fraud scheme and returns never existed, why are we paying any tax at all? And why should it be that we can claim back a portion of paid tax based on “investors having made a ‘clear mistake or simple oversight’ when calculating their RAM income” not the fact that the returns never existed and that it was fraud! This is a joke!

Why, after 18 months are we really none-the-wiser as to what happened? All I feel we’ve done is pay a whopping amount of money to PwC for what??? Who’s holding PWC to account? I am so disappointed there was no contestability around their appointment. I just get the feeling they’re hanging on in until the money runs out.

[RAMIG comment. We did contest the appointment of PwC and tried to get another liquidator appointed as well. We also tried to get additional information. The authorities opposed us and the judge bought it. There will be another time].

*34 Why were charges not also brought against David’s wife? She was a 50% partner in Ross Asset Management and has profited from the Ponzi scheme over the last 10+ years. If she truly was “in the dark” about the company’s operations, so what; she either trusts David to run the company and accepts liability for his actions or she should show an active interest in her company. If she had nothing whatsoever to do with the running of the company, the only reason for listing her as a part owner would be for tax avoidance purposes.

Might I add that if the family was in the dark regarding David Ross’s illegal actions then why was it their money was sheltered from rather than invested in Ross Asset Management.

*35 I have always wondered where David went on his regular trips over seas and what he was doing while he was there. Was he investing off shore for himself?

Have the authorities made a detailed analysis of all of David Ross’ overseas trips? This could identify a pattern to which countries he has been visiting which may lead to the discovery of hidden offshore assets? Who was his travel agent?

e.g. we saw David Ross at Auckland airport – first class lounge – he stated he was on his way to South Africa for a conference. There was an Investing in African Mining Conference 7-10 Feb, 2011 which coincides with his trip (if that was the one he was attending).

*36 I would like to ask when do the receivers believe that the Ponzi scheme began and are there accurate records before that date?

*37 Just two questions that I would like to hear the answer to;

Ross had not paid tax for the last two years….a criminal offence. The fact that the IRD did not pick up and act on this allowed Ross to continue to operate for a further two years. Taking the appropriate action would have closed him down. This represents gross negligence on the part of the IRD. What is the corrective action and what is the culpability of the IRD in this area.

From the onset, the FMA put the responsibility firmly on the investors with public statements to that effect. They accused investors of not “doing their homework”. They made statements that investors with Ross must be “wholesale” investors (a statement that has been proven to be completely untrue). Later it was exposed not only that the FMA were informed about suspicious dealings at Ross, but also that the FMA did not carry out due diligence and correctly check Ross’ credentials (the very thing that they had accused investors of). Making matters even worse the FMA carried out their own internal inquiry which claimed their only shortcoming was in not educating investors better. It completely glossed over the gross negligence of not carrying out due diligence and checking credentials, the ignoring of information given, and the slander of robbed investors (some may even consider this criminal negligence).

*38 Why has the FMA not given a public apology for the way it has treated investors and for the gross negligence that is has been guilty of in this case? What accountability does the FMA have for these failings?

*39 I am interested to know what has happened to the money that was supposedly left. There were indications that at one stage the receivers had come up with a sum around the $10-$11 million mark.

According to an update sent out from PWC around mid October last year they had $1.83 million on hand approximately out of which they had to take further legal and receiver expenses up to that date let alone for work done since.

Is it possible to look at a simple reconciliation sheet indicating where the millions that we thought were left have gone and currently what is left.

From memory Ross also sold some paintings to pay his legal fees, how come that was allowed to happen.

*40 Ross stole our money and now it appears that unless the liquidator does a good job we may get little of our stolen money back. If we are not to get our stolen money back will we be told who has our money and why they will be allowed to keep it? Will we be told the names of the people who have got fat on our savings, and how much they have each gained from us? How can it be justified that they might keep stolen money and still have their identities protected?

*41 The government has just implemented legislation that holds beneficiaries partners jointly accountable for any welfare fraud and subsequent debt created because of dishonesty. Such legislation should be applied to the partners of white collar criminals; such as Jillian Ross (has she ever apologised for what happened?).

The difference between the RAM Investors Group and the Liquidation Committee

The RAM Investors Group (RAMIG) is not the same as the RAM Liquidation Committee, and RAMIG members should be clear in their minds about the difference.

The RAM Liquidation Committee was initiated by the liquidator (PwC) and comprises 7 members that were elected by postal ballot of investors. The RAM Liquidation Committee’s job is to advise the liquidator, it cannot tell the liquidator what to do.

The liquidator is liable for his actions relating to the liquidation, the members of the RAM Liquidation Committee do not have any such liability.

Several members of the RAM Liquidation Committee are also members of the RAM Investors Group (RAMIG).

The Liquidation Committee has agreed that an update on matters discussed at their meetings will be provided in a summarised form following the meetings. Whilst efforts will be made to provide as much information as possible, it should be noted that some matters discussed at these meetings will be confidential and/or subject to legal privilege.

Who is David Ross?

His full name is David Robert Gilmour Ross. He and his wife Jillian Elizabeth Ross are equal shareholders in Ross Asset Management Limited. David was the only Director.

His full name is David Robert Gilmour Ross. He and his wife Jillian Elizabeth Ross are equal shareholders in Ross Asset Management Limited. David was the only Director.

His lawyers are Chapman Tripp.

Here is his profile on the Sharkpatrol website ( includes Companies Office data ).

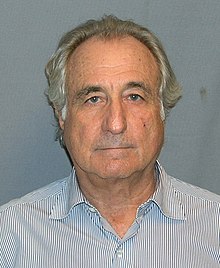

There are very few or up to date publicly available photographs of David Ross. This one was taken some years ago.

And here’s a more recent one.

What is a Ponzi Scheme?

A Ponzi scheme is a fraudulent investment operation that pays returns to its investors from their own money or the money paid by subsequent investors, rather than from profit earned by the individual or organization running the operation.

The Ponzi scheme usually entices new investors by offering higher returns than other investments, in the form of short-term returns that are either abnormally high or unusually consistent. Perpetuation of the high returns requires an ever-increasing flow of money from new investors to keep the scheme going. [ Wikipedia ]

What Companies are involved?

What Companies are involved?

• Ross Asset Management Limited

• Bevis Marks Corporation Limited

• Dagger Nominees Limited

• Mercury Asset Management Limited

• Ross Investment Management Limited

• Ross Unit Trusts Management Limited

• United Asset Management Limited

• McIntosh Asset Management Limited

• Chapman Ross Trust

• Woburn Ross Trust

[ Source: FMA ]

Ross Asset Management Limited ?

No Website.

Physical Address: Level 14, Morrison Kent House, 105 The Terrace, Wellington Central, Wellington City, Wellington.

Postal Address: P O Box 2552, Wellington, 6140

Is this another Madoff scandal?

The Madoff investment scandal broke in December 2008 when former NASDAQ chairman Bernard Madoff admitted that the wealth management arm of his business was an elaborate Ponzi scheme.

Based on the information in the public domain now, it appears that on scale this is New Zealand’s equivalent to the Madoff scandal.

However, while the Ross and Madoff crimes are depressingly similar, there is a gob smacking difference in the most important part, the recovery of the stolen money afterwards by the authorities. The Madoff recovery seems to be managed in a crisp and professional manner, the Ross recovery so far seems to look so bad by comparison it is almost unbelievable.

The Madoff trustee in New York (Irving Picard, the equivalent of a liquidator in NZ) states he is committed to recovering as much of the stolen money as possible, and he appears to be on track to recover nearly 100% of the money Madoff stole, or about $18 billion. Picard is committed to returning this money to the parties it was stolen from.

By comparison the Ross recovery is to date a morass of confusion and despair, well over a year after the fraud was exposed. The Ross liquidator seems so far to have shown non of the commitment or clarity of purpose exhibited by Picard. Ross investors who have lost money still have no idea what return in the dollar on their stolen investments they can expect, but expectations seem to be getting set very low. Hints in the media of about 20 cents in the dollar return may be much lower when the (expected to be massive) expenses are deducted.

The Ross investors have so far been remarkably patient, but the NZ authorities, including the RAM liquidator, must soon start to show progress comparable to the Madoff situation.

What is the FMA and what will they do?

Role & Purpose: The Financial Markets Authority enforces securities, financial reporting, and company law as they apply to financial services and securities markets.

We also regulate securities exchanges, financial advisers and brokers, trustees and issuers – including issuers of KiwiSaver and superannuation schemes. Shortly we will also regulate auditors.

Efficient financial markets are critical to achieving economic and social goals. They ensure investment finance reaches productive firms – helping them to grow, and create employment and wealth. Efficient financial markets also offer investors the opportunity to create diversified portfolios that can achieve their personal financial goals, including a comfortable retirement.

FMA’s role is not to direct investors’ capital or remove risk from investing. No regulator can prevent all loss. We can, however, promote investment markets that are fair, efficient and transparent. [ read more ]

What they do: The Financial Markets Authority’s main objective is to promote and facilitate the development of fair, efficient and transparent financial markets. [ read more ]

What is the SFO and what will they do?

The Serious Fraud Office (SFO) is a small, highly specialised government department responsible for complex or serious fraud investigations and prosecutions. This doesn’t include more common dishonesty offences, which are a Police matter.

Priority cases for the SFO include:

- Multi-victim investment fraud

- Fraud involving those in important positions of trust (e.g. lawyers)

- Matters of bribery and corruption

- Any other case that could significantly damage New Zealand’s reputation for fair and free financial markets minus corruption.

The type of investigations already undertaken by the SFO include Ponzi schemes.

The Serious Fraud Office (SFO) confirmed on the 19th November 2012 that it had commenced a formal investigation into David Ross, Ross Asset Management Limited (In Receivership) and associated entities.