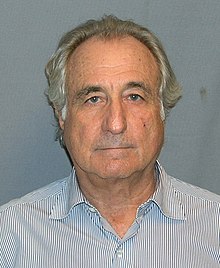

The Madoff investment scandal broke in December 2008 when former NASDAQ chairman Bernard Madoff admitted that the wealth management arm of his business was an elaborate Ponzi scheme.

Based on the information in the public domain now, it appears that on scale this is New Zealand’s equivalent to the Madoff scandal.

However, while the Ross and Madoff crimes are depressingly similar, there is a gob smacking difference in the most important part, the recovery of the stolen money afterwards by the authorities. The Madoff recovery seems to be managed in a crisp and professional manner, the Ross recovery so far seems to look so bad by comparison it is almost unbelievable.

The Madoff trustee in New York (Irving Picard, the equivalent of a liquidator in NZ) states he is committed to recovering as much of the stolen money as possible, and he appears to be on track to recover nearly 100% of the money Madoff stole, or about $18 billion. Picard is committed to returning this money to the parties it was stolen from.

By comparison the Ross recovery is to date a morass of confusion and despair, well over a year after the fraud was exposed. The Ross liquidator seems so far to have shown non of the commitment or clarity of purpose exhibited by Picard. Ross investors who have lost money still have no idea what return in the dollar on their stolen investments they can expect, but expectations seem to be getting set very low. Hints in the media of about 20 cents in the dollar return may be much lower when the (expected to be massive) expenses are deducted.

The Ross investors have so far been remarkably patient, but the NZ authorities, including the RAM liquidator, must soon start to show progress comparable to the Madoff situation.